Join the campaign for fairer tax on Scotch

Time left for the Chancellor to show support for Scotch

JUMP TO...

As the UK’s biggest food and drink export, Scotch Whisky is integral to the government’s growth agenda, boosting jobs and investment here at home.

The challenge

Scotch Whisky producers are facing economic headwinds, both here in the UK, and in our key global markets.

At home

Spirits like Scotch Whisky make up a third of sales behind the bar, but duty hikes from the Treasury have seen the price of a bottle of Scotch Whisky rise significantly following a cumulative 14% duty increase in just two years. Input costs to produce our world-class spirit are rising, including employment costs, raw materials, and the additional burden of Extended Producer Responsibility fees.

In global markets

Tariffs in the US – our biggest market by value – are impacting producers’ certainty, planning and market share. The UK-India FTA was welcomed by our sector, but the gains we will see are long term – perhaps 10 years into the future. Security and confidence for our exports is needed now.

"It's #ScotchWhisky. It's Scottish. It's in Scotland. Support us."

As MPs return to Parliament, distillers across Scotland ask HM Treasury to #SupportScotch in the Autumn Budget.

Did You Know?

The Scotch Whisky industry contributed £7.1 billion to the UK economy in GVA in 2022.

Voters want to see Scotch supported

The Facts

- Scotch Whisky exports were worth £5.4bn in 2024

- The Scotch Whisky industry supports 66,000 jobs across the UK

- There were 2.7m visits to Scotch Whisky distilleries in 2024

Read more about Scotch Whisky's economic impact here

Treasury revenue is flatlining

The Treasury recent duty increases have not delivered the promised revenue. The OBR recently revealed that forecasts had been overestimated, and that bears out in HM Treasury receipts: in 2024-25, £4.165 billion was collected in spirits excise duty, £676 million (14%) less than the OBR’s two-year forecast in March 2023.

Despite a cumulative 14% increase in spirits duty since November 2023, the Treasury’s revenue from spirits have flatlined.

What can be done?

Ahead of this year’s Budget, it’s vital the Treasury listens to the on-the-ground concerns of businesses as we call for greater support amid a challenging and unpredictable economic climate.

The Chancellor must take action to reduce the globally high tax burden in the UK Autumn budget. This will take the pressure off producers, give companies the breathing room to invest, and nurture a home-grown product from grain to glass, from Annandale to Orkney.

With over 40 000 jobs supported across Scotland, and more across the wider UK, the economic impact of Scotch Whisky cannot be overstated. Supporting production, logistics, hospitality and more, the industry invests in people. We're calling on the UK Government to recognise the contribution of the sector and commit to #SupportScotch in the upcoming Autumn Budget, with a multi-year freeze on excise duty - so the sector can focuses on what it does best: bringing a world-class product to consumers across the country and around the world.

More to come...

“As Executive Chef at The Glenturret my job is to explore Scotch Whisky in a different way: playing with flavours, aligning distillation processes and techniques, and creating subtle nods throughout our menu has allowed me to introduce our guests, wherever they are in their whisky journey, to the versatility of Scotland’s national drink. Scotch Whisky plays a vital part in restaurants, bars and pubs all over the world, and I'm proud to have led the team at The Glenturret to become the first Michelin starred restaurant in a distillery.”

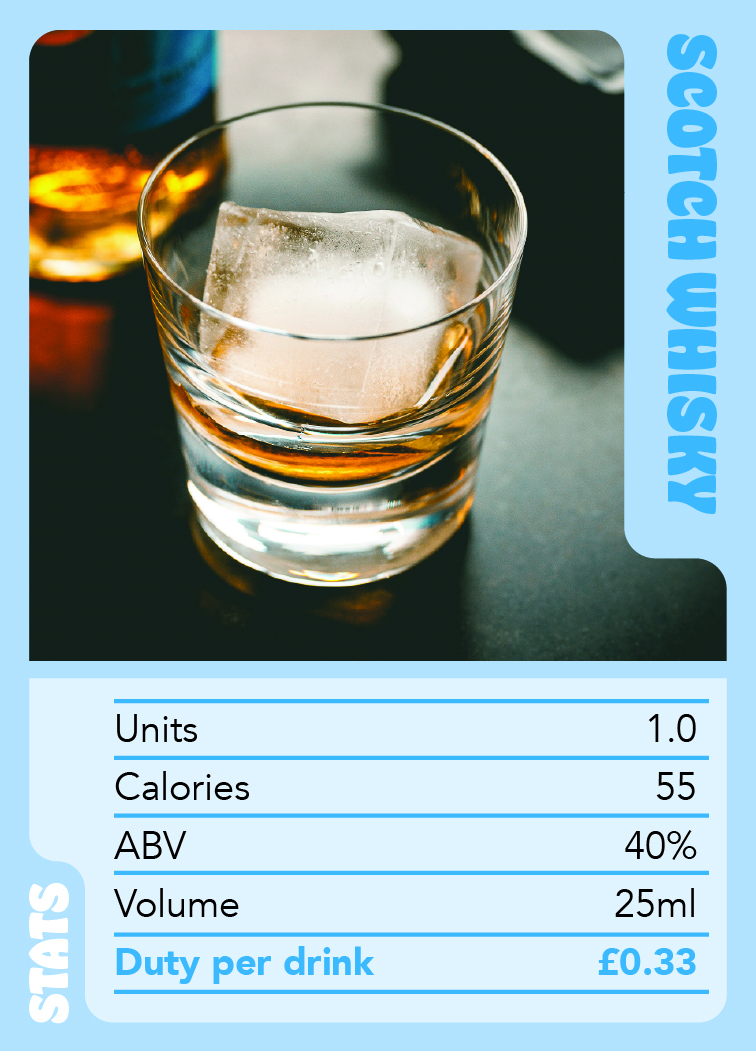

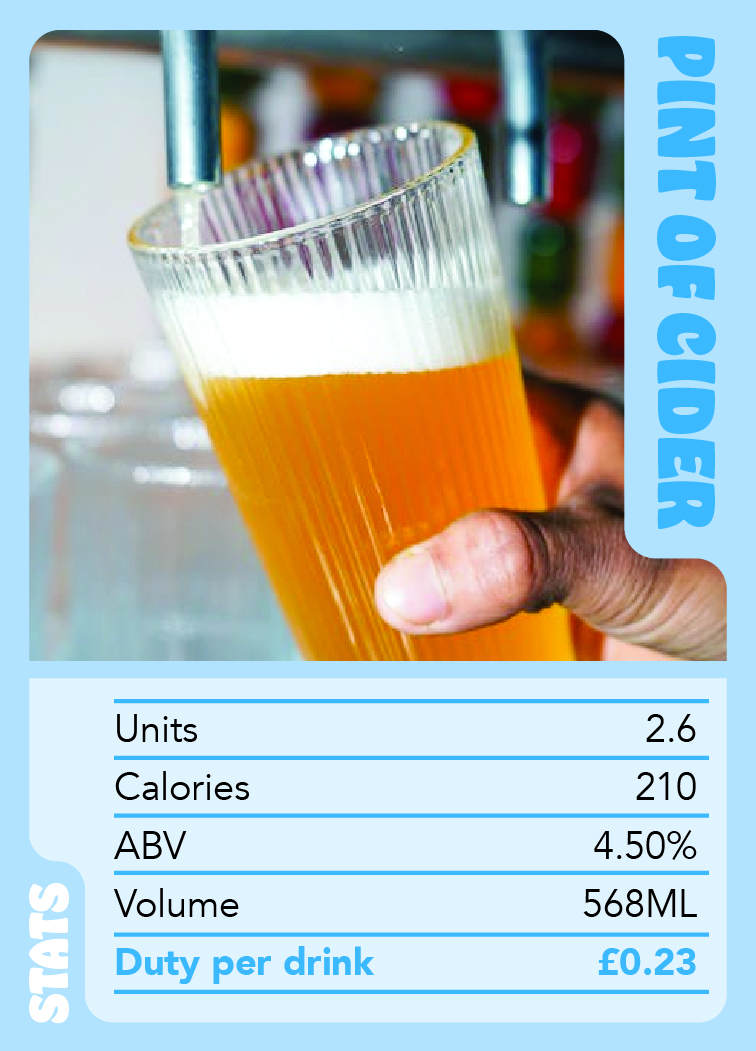

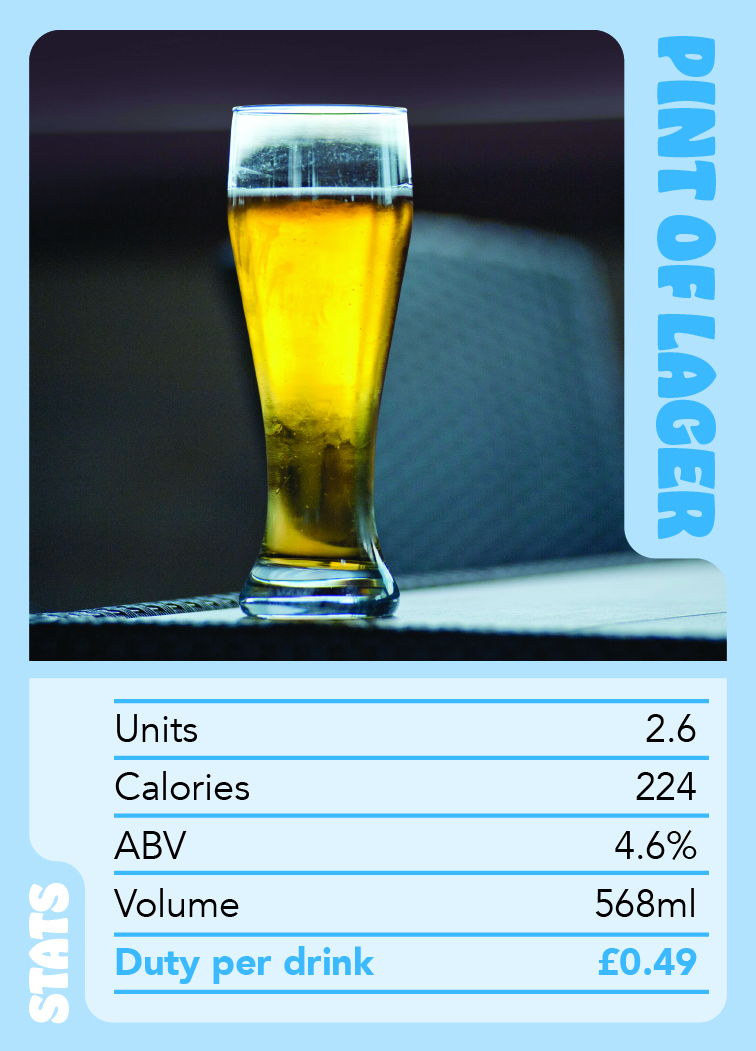

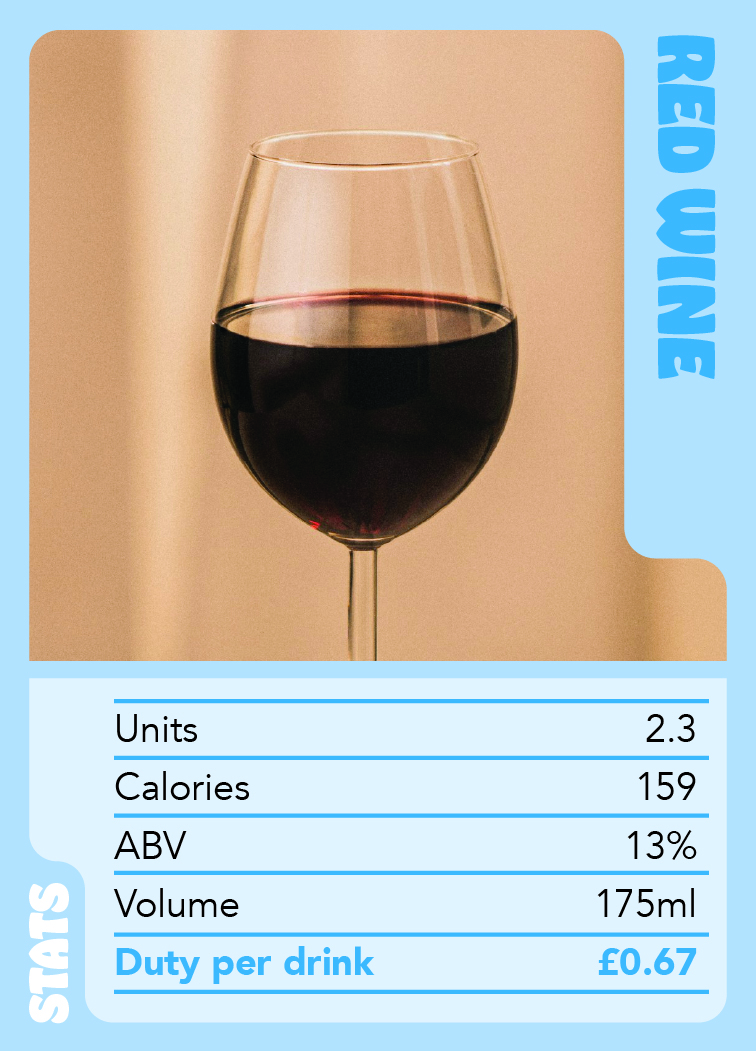

Explore Pour Scores

Tax disparity isn’t a game. Learn more about the differentiation and unfairness of how spirits are taxed vs other alcoholic products like beer and cider, despite being lower in both units and calories per drink. Higher strength doesn’t mean higher harm, and shouldn’t mean higher tax.

"What I'd like to see in the Budget, is the Chancellor take a look at how by reducing, freezing duty on [Scotch] whisky, we could actually get more into the Exchequer."

At our event in the House of Commons, we spoke to MPs from across the political spectrum and the country about why the UK Government needs to #SupportScotch with a duty freeze on spirits in the upcoming Budget.

Proud to back a freeze in spirits duty and support Scotch Whisky's long-term future @ScotchWhiskySWA #IMakeWhisky pic.twitter.com/kSgcWP9GBe

— Jamie Stone MP (@Jamie4North) September 2, 2025

I’m delighted to be supporting @ScotchWhiskySWA campaign for a long-term freeze to spirits duty. At the Autumn Budget, the Chancellor must back #ScotchWhisky and allow this iconic industry to invest in jobs & communities, securing growth for the future #SupportScotch pic.twitter.com/1N6MxUwt59

— Murdo Fraser (@murdo_fraser) September 22, 2025

"What I'd like to see in the Budget, is the Chancellor take a look at how by reducing, freezing duty on [Scotch] whisky, we could actually get more into the Exchequer."

— Scotch Whisky Association (@ScotchWhiskySWA) September 6, 2025

At @UKparliament earlier this week, we spoke to MPs from across the political spectrum and the country about… pic.twitter.com/0aCIHP9zzh

"The Scottish whiskey industry is vital to the Scottish economy."

— That’s TV Aberdeen (@ThatsTVAberdeen) September 21, 2025

MP @SeamusLoganMP spoke to That's TV about why he is supporting @ScotchWhiskySWA call for a duty freeze ahead of the November Budget. pic.twitter.com/BvjP9nV0jO

Pleased to add my support to calls from @ScotchWhiskySWA for a duty freeze ahead of the Budget in November.

— Seamus Logan MP (@SeamusLoganMP) September 4, 2025

With over 1000 jobs in the #scotchwhisky sector lost since the last Budget, it's vital that the UK Government support this iconic product. pic.twitter.com/q3s1DhDOHU

Thank you to all the MPs who attended our drop-in event at @UKParliament today, and @WendyChambLD for sponsoring.

— Scotch Whisky Association (@ScotchWhiskySWA) September 2, 2025

As the #ScotchWhisky industry faces challenges globally and domestically, we're asking for the UK Government to #SupportScotch with a multi-year freeze on spirits in… pic.twitter.com/6vZ8UArQmh